Goldilocks and the Gorillas (June 2023)

Risk Commentary

Goldilocks and the Gorillas (June 2023)

Did you Know? 47 of the top 50 life insurance companies hold long-term bonds that have solicited ratings by Egan-Jones? [1][2]

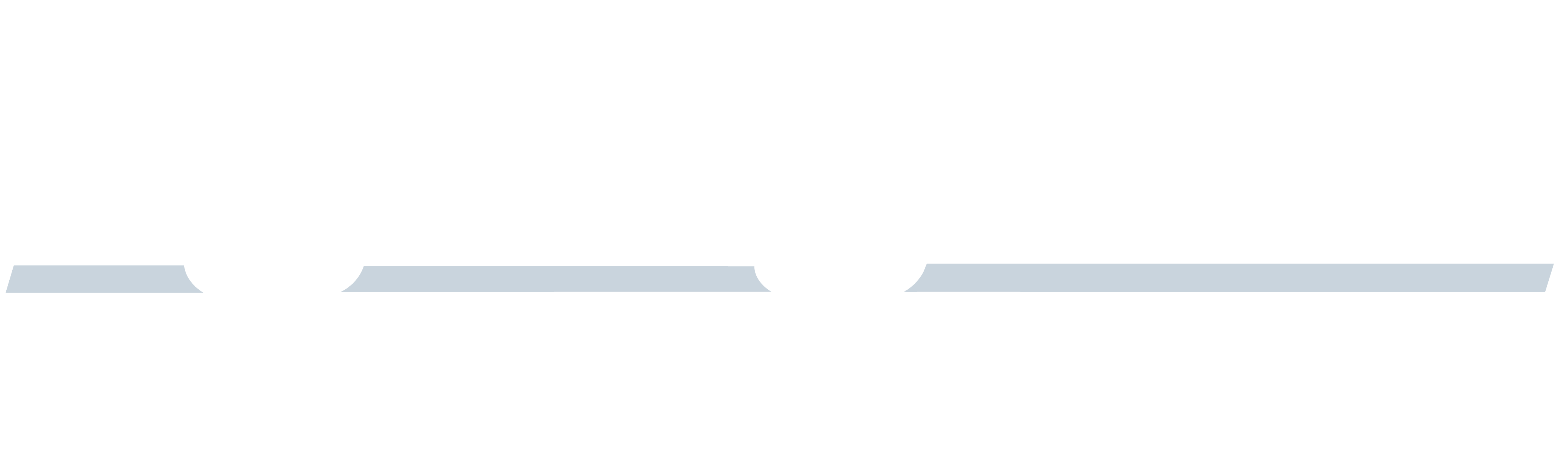

The tale of Goldilocks is well-known; it basically involves the protagonist, Goldilocks, finding the ideal temperature for a satisfying meal. Using Goldilocks as a metaphor, conditions in the private debt space are ideal - satisfying returns are paid in base rates and spreads, leverage is low, and defaults are moderate. Given low leverage and the ample private equity dry powder, it is likely that recovery rates will be attractive. Below is a summary of prior and current conditions.

Figure I: Private Debt Condition Changes

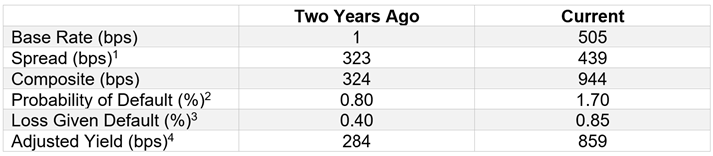

Figure II: Secured Overnight Financing Rate (%)

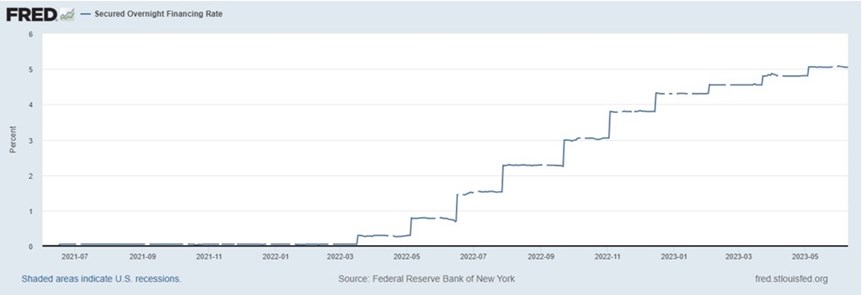

Figure III: ICE BofA US High Yield Index Option-Adjusted Spread (%)

A relevant question is why conditions allow such propitious conditions to exist for private debt. Our view is that one is temporal and the other structural.

On the temporal side, the structured finance markets have been on pause for the better part of 12 months. These fair-weather friends (particularly the “AAA” buyers) have taken leave upon the central banks stoking up their war on inflation.

On the structural side is the awakening of the banks and perhaps more importantly, the regulators to the renewed importance of asset/ liability management. Whether intentional or not, the banks were encouraged to buy “low risk” assets in the form of treasuries and agency-backed securities. While the assets were low risk from a credit perspective, they were massively risky from an interest rate perspective. The unprecedented rise of Fed funds rates and electronically driven deposits shifts led to a new paradigm for many banks. The new norm appears to be a “thin bank” whereby the traditional lending functions are limited in favor of a simple deposit and trust services function.

So where is the Nobel-winning economist Eugene Fama, who claimed that markets are efficient and that all discrepancies are arbitraged away? In our opinion, this theory, like many academic teachings, has merits but often breaks down in practice. As is often the case, technology has reduced deposit duration. Furthermore, regulators are forced to react and pressure banks to better match the duration of assets (i.e., loans and securities) to the now much shorter duration of liabilities (i.e., deposits).

Back to our headline, given the size of the two gorillas, (i.e., the CLOs and the banks) the private debt providers are enjoying highly favorable or “goldilocks” conditions. As usual, there is a rub, and that is while market conditions are propitious, many investors have had difficulty raising capital. To support raising capital, many clients have used structured notes which benefit from diversification and a deep demand base.

____________________________________________

[1] Data Source: National Association of Insurance Commissioners, by permission. The NAIC does not endorse any analysis or conclusions based upon the use of its data. Market share determined by direct written premiums.

[2] The analysis of the NAIC Data by Egan-Jones has been validated by RiskSpan, Inc.

[3] ICE BofA High Yield Option-Adjusted Spread (from FRED). Note, the Private Debt spreads are typically greater than HY.

[4]https://www.forbes.com/sites/mayrarodriguezvalladares/2022/09/26/probability-of-default-is-rising-for-high-yield-bonds-and-leveraged-loans/?sh=494d6bd9648f

[5] Estimated at 50%

[6] Composite yield – (Probability of DefaultxLoss Given Default)

How we can help

Founded in 1995, Egan-Jones is a Nationally Recognized Statistical Rating Organization (NRSRO) and is recognized by the NAIC and is certified by ESMA. We can help in the following areas:

Requested Ratings – we assist investors access private and public markets via ratings.

Subscription Ratings – we provide early, accurate, and independent credit rating research.

Independent Proxy Research and Recommendation/Voting – we assist fiduciaries fulfill their voting and record-keeping obligations.

Egan-Jones rates a wide variety of private placements:

Aircraft Lease and Loans

Airline Lease Back

Asset-backed loans

Bank, BDCs

Credit Facility/ Warehouses

Corporates

Credit-Tenant Loans (CTLs)

Equipment Leases

Financial Institutions

Ground Leases

Insurance

Middle Market Lending

Project Finance

Real Estate, REITs

Specialty Finance

CRE Loans, Other

Funds:

Closed-end Funds

Credit Funds

CRE Funds

Direct Lending Funds

Feeder Funds

Infrastructure Funds

Liquidity Funds

Mezzanine Funds

Mixed Strategy Funds

Opportunistic Funds

Real Estate Funds

Structured Debt Funds

Click here to view sample Private Placement transactions.